The State of Banking in the US

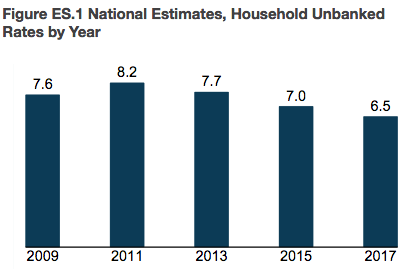

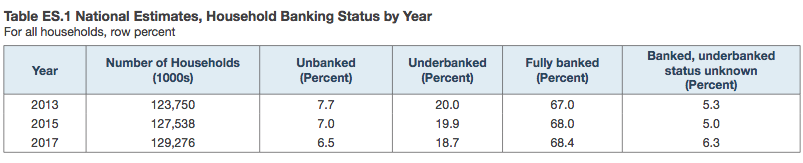

In 2017, the FDIC estimated that 6.5 percent of households in the United States were unbanked and 18.7 percent of households were underbanked. What do these terms mean, and why is this significant?

How Banking Status is Characterized

The FDIC defines “unbanked” as: “no one in the household had a checking or savings account”. For “underbanked” households, they “had an account at an insured institution but also obtained financial products or services outside of the banking system.” For example, an underbanked household could have a checking account but also utilize payday loans, pawn shop loans, or other non-banking system services. In this specific 2017 study (FDIC National Survey of Unbanked and Underbanked Households), the FDIC surveyed 35,000 households in the US to create these estimates.

Estimates for US Banking Status Classification

In the above chart of unbanked rates for each year, the percentage of households appears to be moving directionally in a favorable way. Notably, the unbanked rate of 6.5 percent is actually the lowest figure since the survey started in 2009. The FDIC does state that controlling for the increases in socioeconomic circumstances, the change between 2015 and 2017 is not statistically significant.

Looking at the categories that detail the banking statuses of other segments of the population, 18.7 percent of households are underbanked and 68.4 percent are fully banked. Curiously, the “unknown” status group actually increased by 1.3 percentage points to 6.3 percent. I couldn’t locate a proposed explanation for this, but in the worst case scenario, shifting the entirety of that cohort into the “unbanked” category would certainly make the results more alarming.

Why Households Are Unbanked

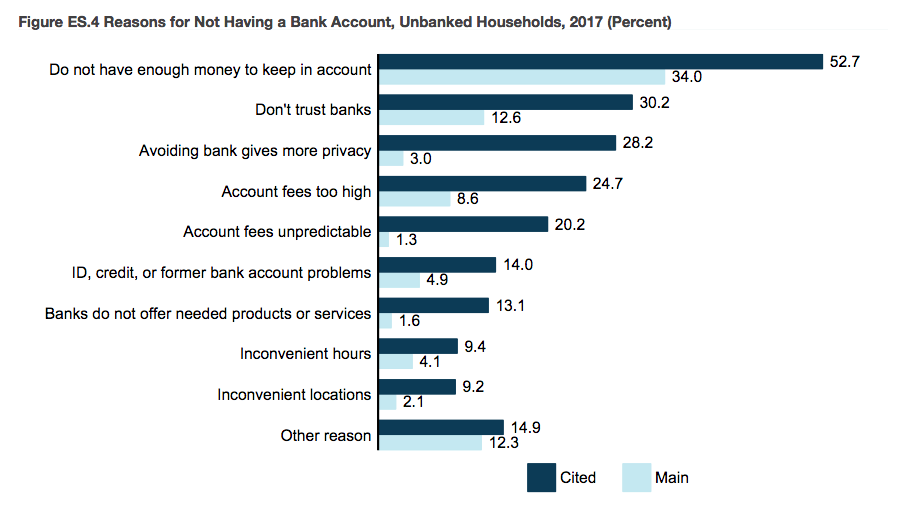

In its study, the FDIC also asked unbanked households to describe the reasons for their banking status. Most commonly, households explained that they “do not have enough money to keep in account.” Checking and savings accounts often require a minimum balance that can be a barrier to entry for those that cannot put aside that amount of money. In addition to being the most common response, this category was also the foremost “main” reason for households. The second and third most popular reasons were that households did not trust banks and that eschewing traditional bank accounts grants the household additional privacy. These selections seem intertwined to some degree and may be the result of existing reverberations from the 2008 financial crisis.

Why Bank Accounts are Important

In their simplest forms, checking and savings accounts allow individuals to save for the future and absorb unforeseen costs. For FDIC insured firms, there is essentially no risk for households to store money in these types of accounts. The additional services provided by banks (ex. money transfers) are also often cheaper than those provided by non-bank alternatives. Lastly, bank accounts allow individuals to amass a credit history. As many have encountered, this can be indispensable when obtaining a mortgage, applying for an apartment rental, or leasing a car.

Based on the responses offered by unbanked households, banks may be able to increase the rate of households who are fully banked by lowering or eliminating the minimum balance required to maintain an account. FinTech companies such as Dave and Chime already offer accounts without minimum balances. As FinTech firms enter the arenas typically dominated by branch banking institutions, it will be interesting to see how these agile start-ups remove the frictions preventing people today from receiving the benefits of the financial system.

SOURCES

FDIC National Survey of Unbanked and Underbanked Households - 2017