How FinTech Can Advance Millennial Financial Priorities

The millennial generation has probably never endured such scrutiny. Born between the years 1980 and 2000, millennials have emerged to take the spotlight on the world stage. Journalists expend a great deal of energy examining millennial psychology and projecting their habits out into the future.

The millennial generation was heavily shaped by the financial crisis and is now navigating through a global pandemic. These two depressive episodes have justifiably impacted millennial financial habits and priorities. In a recent study (pre-COVID), Bank of America surveyed nearly 2,000 customers (ages 18-73) about their personal finance views. They compared the participant responses across generations and the findings illuminate some key differences between millennials and their older cohorts. FinTech companies can use these results to tailor how they service millennial customers

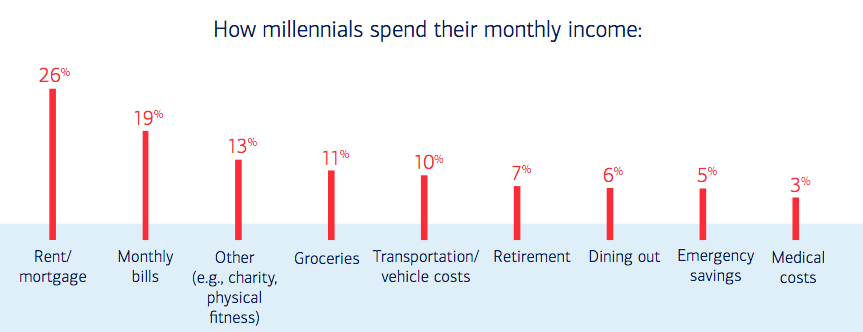

Spending Priorities

As a useful baseline, the above chart breaks out how millennials allocate their monthly income. Based on the report, it seems that debt repayment is grouped into the “monthly bills” category at 10% of the 19%. From my own experiences, I’ve seen how housing expenses eat up the majority of my budget, and I think this presents opportunities for FinTech. Innovative tools can help millennials estimate how much they can afford to spend on housing and also allow them to compare rents/mortgage rates across multiple counterparts (StreetEasy does this already to some degree).

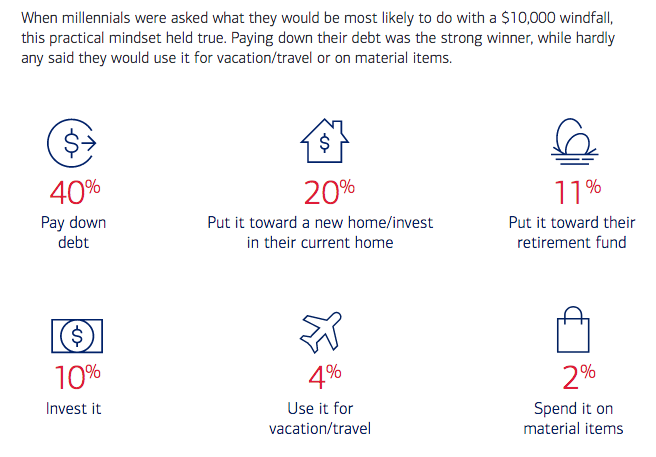

I thought the above graphic/question served as a useful tool to reveal millennial financial priorities. Millennials are unfortunately burdened by high levels of debt and their responses to this question seem appropriate. Depending on the tax deductibility status for their debt and the projections for their possible investments, however, paying down existing debt may not be the most financially prudent decision. FinTech solutions can certainly help millennials view the long term impact and outlooks of near term decisions and help them make the best choice

Family Matters

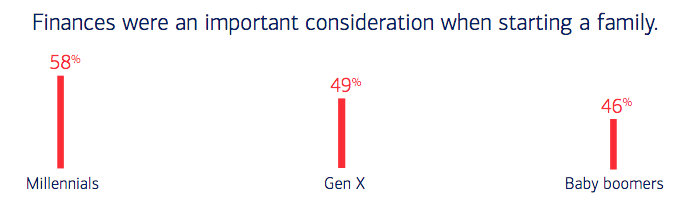

Millennials are more concerned than their predecessors about the costs of starting a family. With college and other education expenses rising, this apprehension is well founded. With enough data, the cost of raising children can be estimated, so FinTech platforms can use parents’s financial resources to accurately project whether having a child is affordable. In tandem, these tools could also help parents start saving early so that children do not become a serious financial burden.

Financial Sacrifices

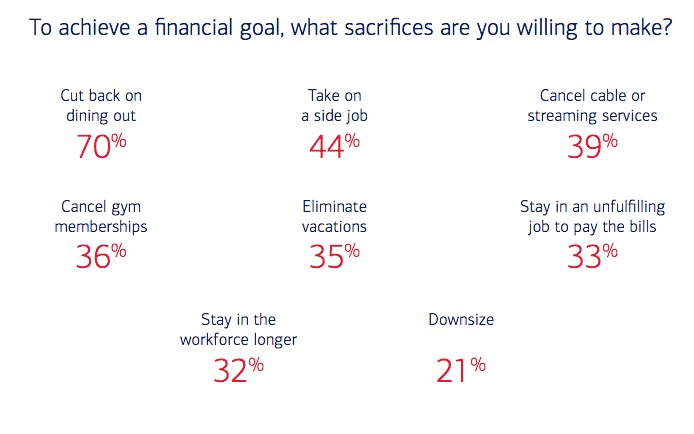

The above question posed by the researchers is an interesting way to measure financial priorities. 70% of millennials were willing to reduce their restaurant budgets, while only 36% would eliminate their gym memberships. Although fitness expenses are presumably smaller than dining costs, these findings generally fit with the trends showing that millennials place a greater weight on wellness and experiences relative to earlier generations. Given that a majority of millennials are willing to decrease their restaurant expenses, FinTech budgeting platforms can help guide these customers to allocate their costs appropriately.

Stressors

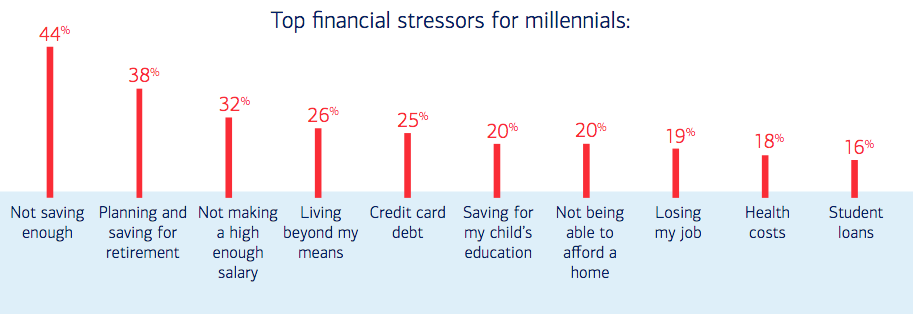

By far, the top two financial stressors for millennials involve saving, both in general and for retirement. This is an easy space for FinTech to upgrade the financial habits of their customers. Modern tools can create customized savings plans for millennials to help them forecast how much money they will have in retirement. On the investing front, FinTech can use advances in machine learning to allow millennials to build a cost-effective passive portfolio. One surprising result from this question is that student loans ranks on the bottom of the list for stressors. Considering that this generation is overloaded with education debt, I would have expected this to rank higher.

SOURCES

https://about.bankofamerica.com/assets/pdf/2020-bmh-millennial-report.pdf