Financial Literacy - A Global Perspective

According to a survey conducted by the Standard & Poor’s Ratings group, 33 percent of adults worldwide are financially literate. At a country level, the results vary widely with financial literacy ranging from 13 to 71 percent.

Methodology

In 2014, the researchers randomly selected and interviewed over 150,000 adults in over 140 different economies. The questions that the researches asked were designed to touch on four different fundamental areas of financial decision making. The concepts that they identified were: interest rates, interest compounding, inflation, and risk diversification.

Here is a sample question from the survey:

INFLATION

Suppose over the next 10 years the prices of the things you buy double. If your income also doubles, will you be able to buy less than you can buy today, the same as you can buy today, or more than you can buy today?

Answer Choices:

less, the same, more, don’t know, refused to answer

Country Level Results

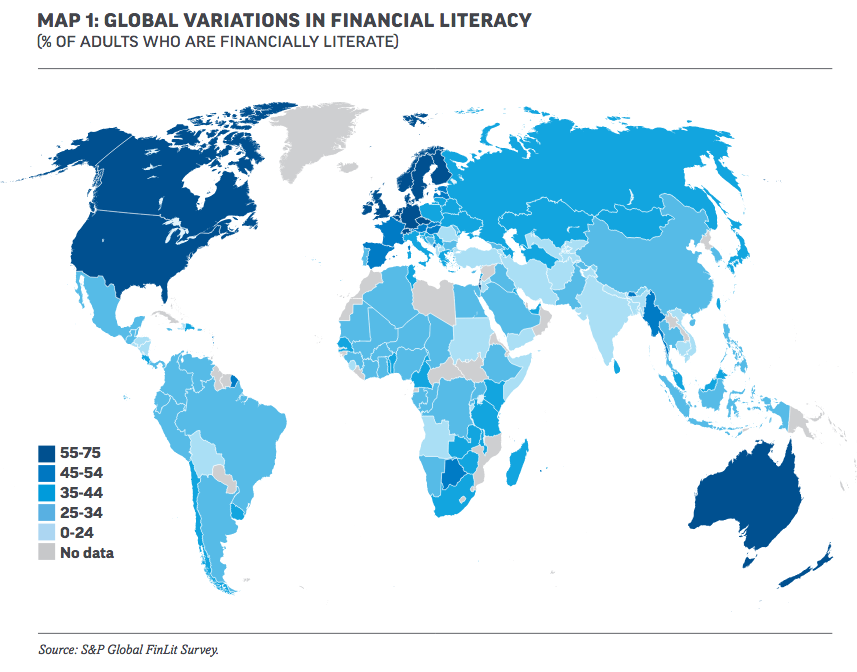

In the above map, financial literacy rates differ substantially across countries. With the exception of Europe, the literacy levels seem fairly consistent within geographic continents.

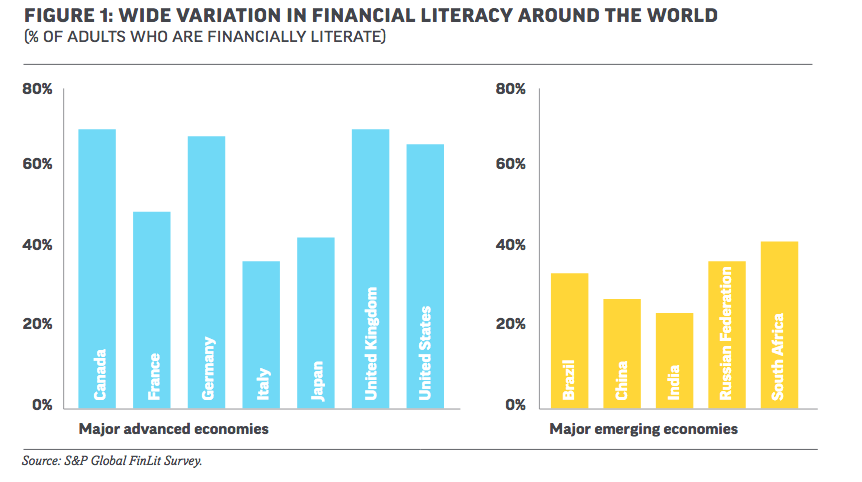

Financial literacy is also generally higher among more advanced countries. They’re not included in the above bar chart, but Norway, Sweden, and Denmark actually boast the highest financial literacy rates (71%) in the survey. Although major advanced economies generally display higher rates of financial literacy, we still see variance within this group. For example, financial literacy stands at 37% percent in Italy and 68% in Canada.

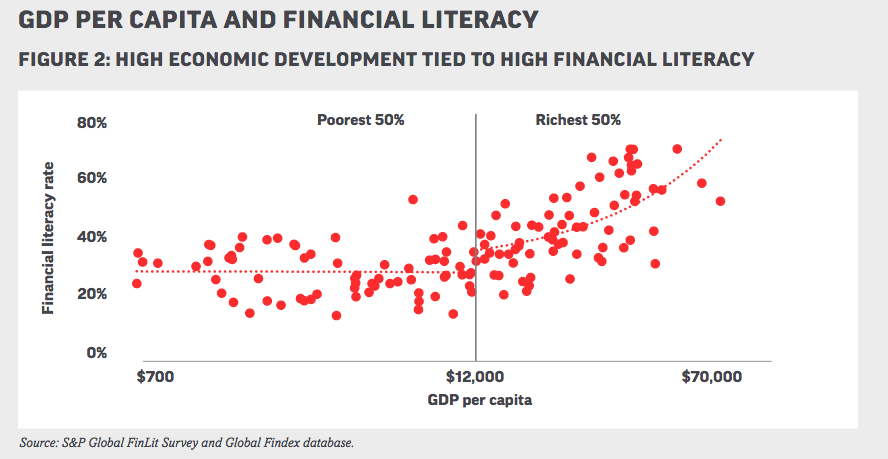

The researchers also examined the relationship between GDP per capita and financial literacy. Using $12,000 as the median GDP per capita, they divided the world into two halves. For the richest 50% of economies, they found that approximately 38% of the differences in financial literacy rates comes from variation in income levels across countries. In contrast, for the poorer 50% of countries, there is no significant relationship.

Topic Results

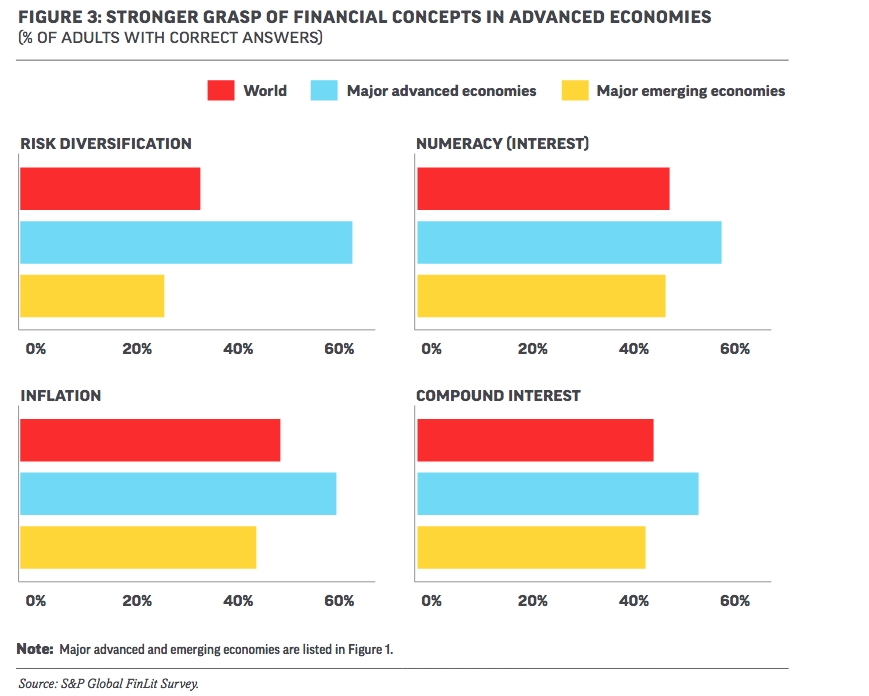

Out of the four topics tested (numeracy, inflation, risk diversification, compound interest), the risk diversification questions produced the smallest percentage of correct answers. Notably, this area also displays the largest discrepancy between advanced economics and emerging economies. Perhaps this is a topic that is more relevant to complicated economies that offer a variety of financial instruments? It is also surprising that the results and breakdowns are almost identical for the other 3 categories.

Financial Literacy and Banking Status

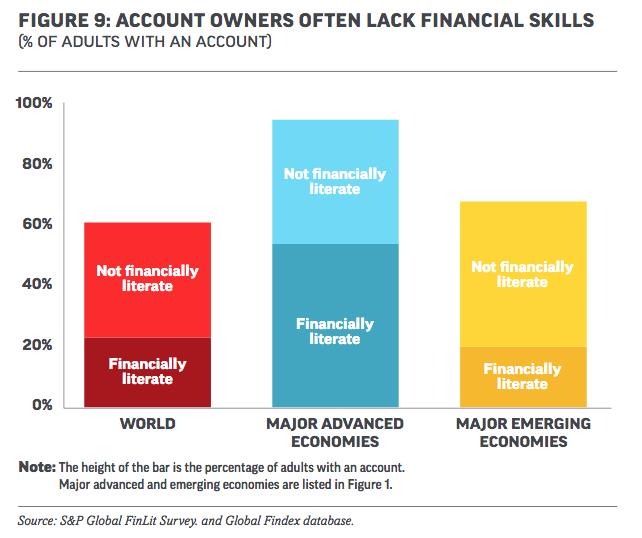

The researchers looked at the banking statuses of survey participants and how that related to financial literacy. Although having access to a bank account is important, it does not guarantee financial literacy. 38% of banked adults worldwide and 57% of banked adults in major advanced economies are financially literate.

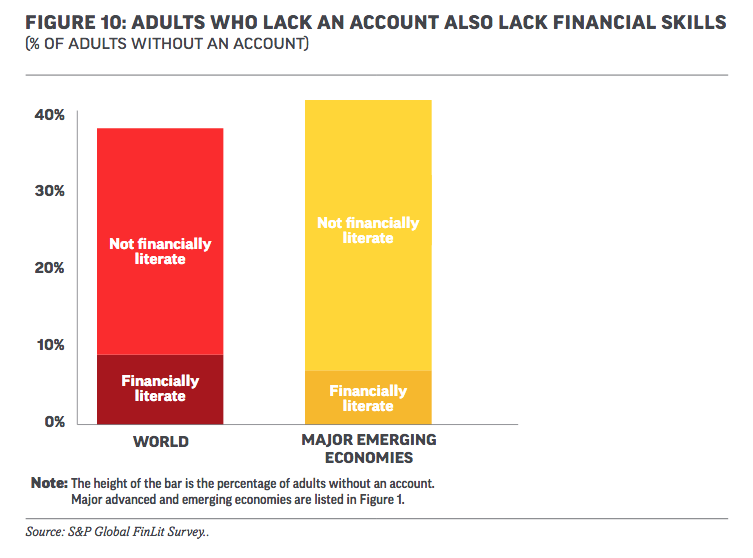

Adults who do not possess a bank account are generally less financially literate than those who do have an account. Worldwide, only 25% of adults who are unbanked are financially literate. The direction of causality is unclear as many people who do not have a bank account cannot afford the minimum balance or simply do not have the opportunity to possess one.

Why is this important?

Financial literacy allows us to navigate the complicated assortment of banking products and effectively decide how to save and invest for the future. As more and more individuals gain access to bank accounts, an awareness of the available financial products is key to ensuring their appropriate use. A misunderstanding of the basic interest calculations related to credit cards or bank loans can have disastrous consequences for an individual’s economic welfare. The S&P researchers argue that given the low rates of financial literacy, governments should create strong consumer protection regimes. In conjunction with their suggestion, I think that it is also imperative for us to improve our current methods of teaching financial concepts.